April has always been a harbinger of change.

In a natural sense, it produces turmoil in the Northern Hemisphere … growth and beauty laced with intense storms and wild swings in temperatures.

Of course, those meteorological transitions pale when you compare them with the societal turmoil, which I feel daily living in the United States in 2025.

My only recourse is to try to make a difference in my own way: stay visible, protest beside like-minded friends …”Hands OFF our Social Security” … all the while remodeling my home with Tom, singing, writing, and leading my memoir writing workshops. (Twelve aspiring writers are meeting with me later today in the middle of three workshop sessions at the Scottsdale Public Library.)

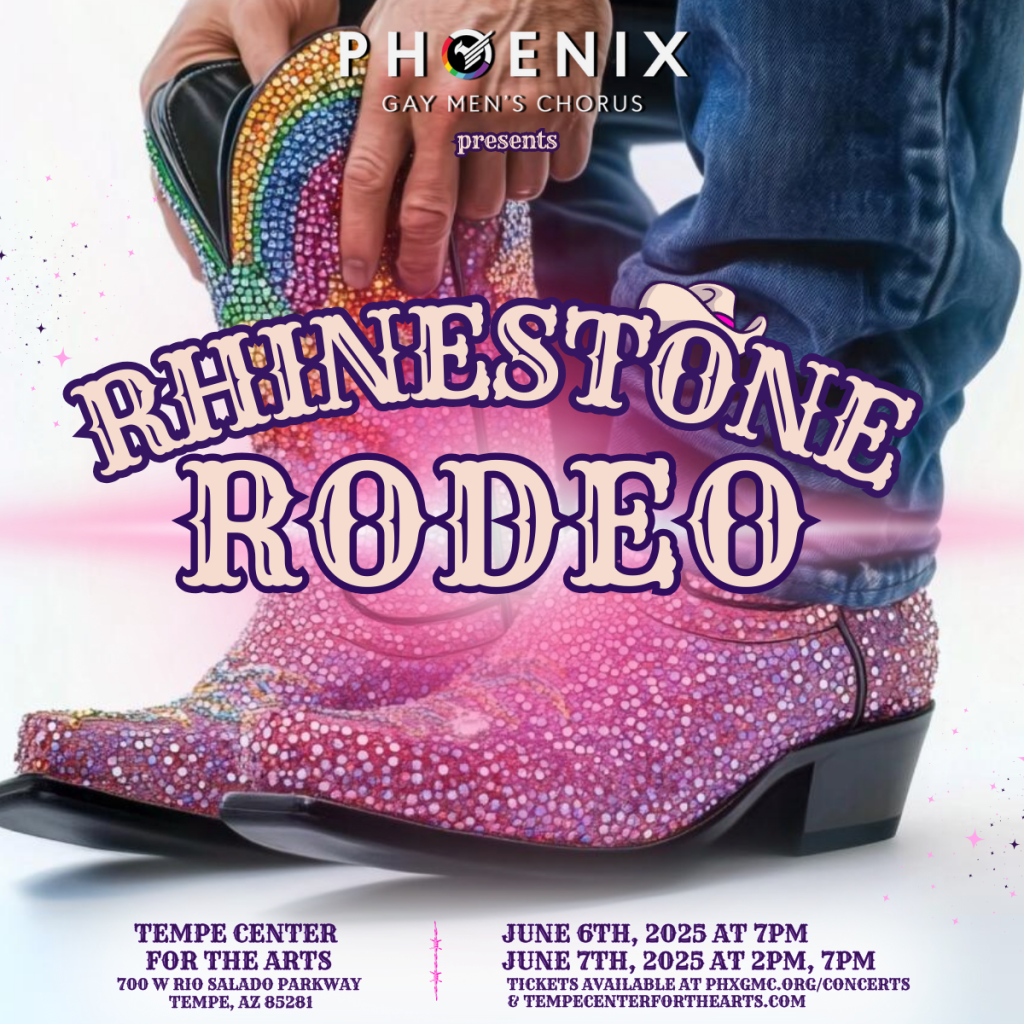

It’s appropriate that my Phoenix Gay Men’s Chorus comrades and I will perform an inspiring arrangement of Bob Dylan’s The Times They Are A-Changin’ at our Rhinestone Rodeo concert on June 6 and 7 at Tempe Center for the Arts.

Because they most definitely are … and you better start swimmin’, or you’ll sink like a stone, for the times, they are a-changin’ …

On to more personal transitions that fly under the radar. It is the grimy stuff of life. A friend’s mother dies. Another grieves the loss of his wife. A third deals with a cancer diagnosis. I will do my best to continue to be there for all of them.

If you live in the Phoenix area, come in from the heat and attend one of our June concerts. We will entertain and energize you … make you smile, laugh, shed a few tears, too … as we lift our voices.

No one can stop me from being who I am … who I love … who I care for … who I sing with.